IT and Management

The lecture about IT and Management was given by Prof. Jiro Kokuryo from the Graduate School of Media and Governance, Keio University. There are several interesting points and ideas which can be extracted from this lecture, which highlighted the title “Understanding the Information Society”.

The business dynamics of the Information Technology world had begun in 1970’s with the development of dynamic improvement in processor capability. In 1972, microprocessor had the capability only about 8 bit and 200 kHz. In about three decades later (2007), it has achieved 64 bit and 2 GHz. This is really a big leap. On the other hand, the software development at that time was just progressing very slowly. So, there’s a big gap between the hardware and software development. Then, what does this mean?

If this kind of bottle-neck happens, then software is the key determinant of the information system design and development. This gap also means a business potential and market segment that could be cultivated further. Moreover, since the construction of Open Architecture, which means the possibility of developing software or application for various platform and hardware, the economics of software will become more challenging and dynamics.

What are essential points in Software Economics? There are two main features that have become common characteristics in software economics. Firstly is the increasing higher fixed cost of development. To develop a new software, the initial capital is usually quite big; this is why we call it higher fixed cost of development. However, this feature should not discourage us; we still have the second feature i.e. low marginal cost of delivery, especially after the emerging of the internet (World Wide Web). What does this second feature imply? It implies that after you reach the Break Even Point (your sale revenue has covered your fixed or total cost), substantially you will never get any more losses; the profit of the software sale keeps going on while your variable cost is almost zero or insignificant. It was this very important characteristic of software economics that made Bill Gates become the richest man in the world.

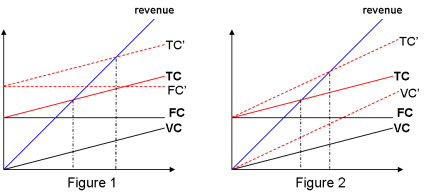

From the Fig.1, we can see that if we have higher Fixed Cost (FC’), then we have higher Total Cost (TC’) and the Break Even Point (BEP) move further to the right-side. This means that higher Fixed Cost will pose higher risk (longer BEP). While in the Fig.2, we can see that higher Variable Cost (VC’) will also cause higher Total Cost (TC’), which also result a little movement of BEP to the right-side. Besides, as we can see in Fig.2, there’s also a gradient change of the TC’ which means that after the break-point (BEP), the potential profit that could be gained become less. This is substantially a disadvantage of higher Variable Cost.

Most of the software businesses possess the characteristics of Fig.1: higher fixed cost but less and almost insignificant variable cost (the gradient of the VC is almost zero). Therefore, whenever the software business reaches the BEP, very high profit could be achieved.

Then, how to run the software business or marketing? Currently, we can see there are several business models that address the software economics. They are:

- Unbundled Software (made to order)

- Package Software (license)

- Subscription Model

- Pay per Use (service model)

- Advertisement Model (free for end users)

Each model has its strong and weak points. Feasibility study and analysis should be made before choosing the models. For example, if your products have a very small (limited) market segment, then certainly the advertisement model will not be suitable for you.

Another feature which becomes very interesting in the information business and society is the network externality effects (more users, greater value). This is almost similar to the economy of scale (quantity). An interesting example is to say, the land-line telecommunication company (NTT).

We can see here that if only one customer exist, the market has no value (for the telecommunication company). When there are two customers, we have one line (one value). Three customers will yield three lines; four customers mean six lines (six values). The value of the market will increase exponentially along with the linier increase in the number of customers. This is what we call the ‘network externality’. Bigger size of the market will produce incredible value, just like the Snow Balling effect.

We can see here that if only one customer exist, the market has no value (for the telecommunication company). When there are two customers, we have one line (one value). Three customers will yield three lines; four customers mean six lines (six values). The value of the market will increase exponentially along with the linier increase in the number of customers. This is what we call the ‘network externality’. Bigger size of the market will produce incredible value, just like the Snow Balling effect.

One evident example of this effect in the information society is Wikipedia. How the interactions among many elements as well as the self-organizing interactions can lead to unexpected outcome.

In my opinion, these unique characteristics of information society and features should be addressed properly, for it will give significant influences in our life in the future. These influences might mean “business potential” for us; however, it could mean “a threat” as well.

(c) WYW

No comments:

Post a Comment